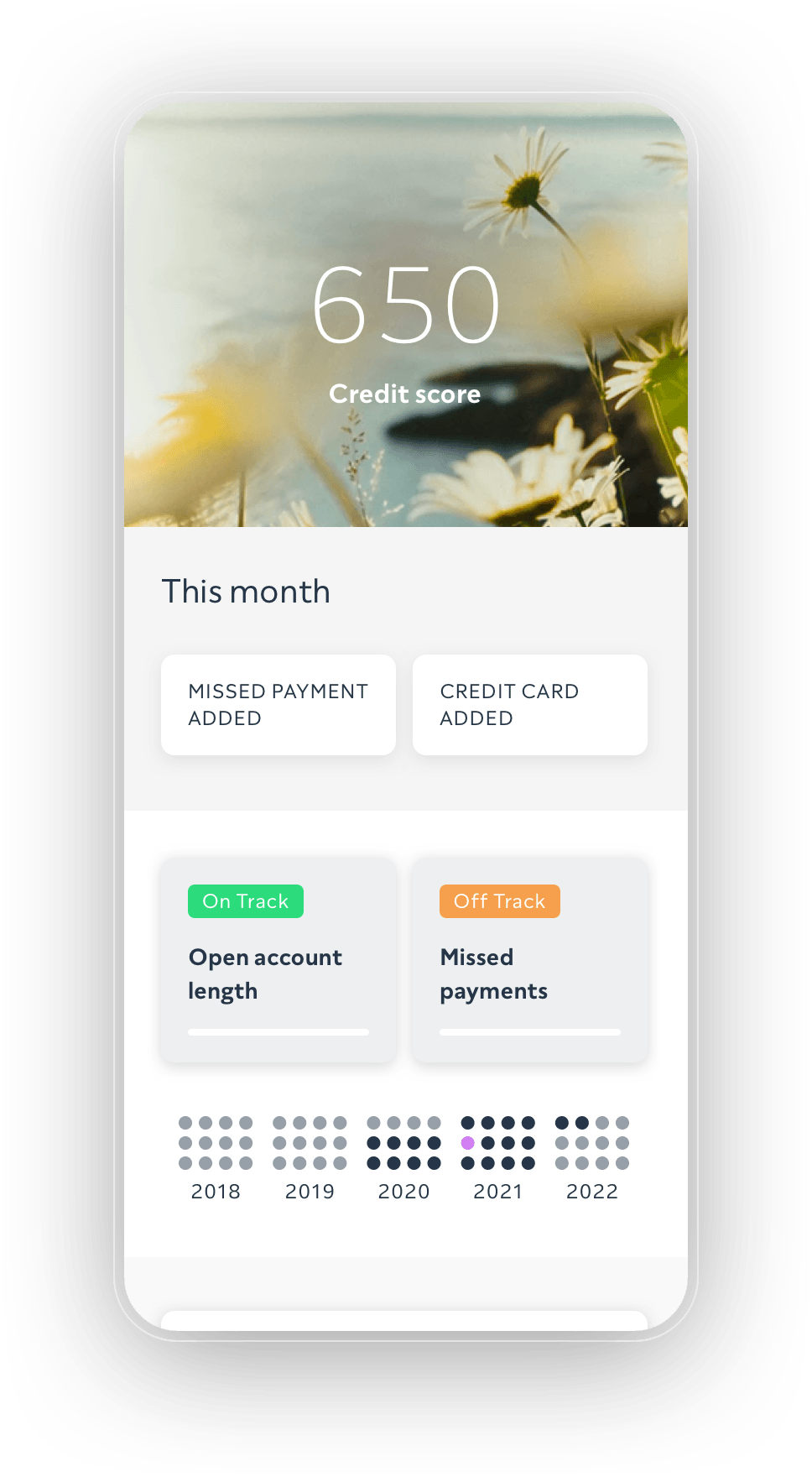

Improve your credit score and get personalised deals

Find out how to improve your credit score

When we share your report with you, you’ll get clear, personalised insights about your credit score and how you can improve it. An improved credit score could get you a greater range of deals with lower rates.