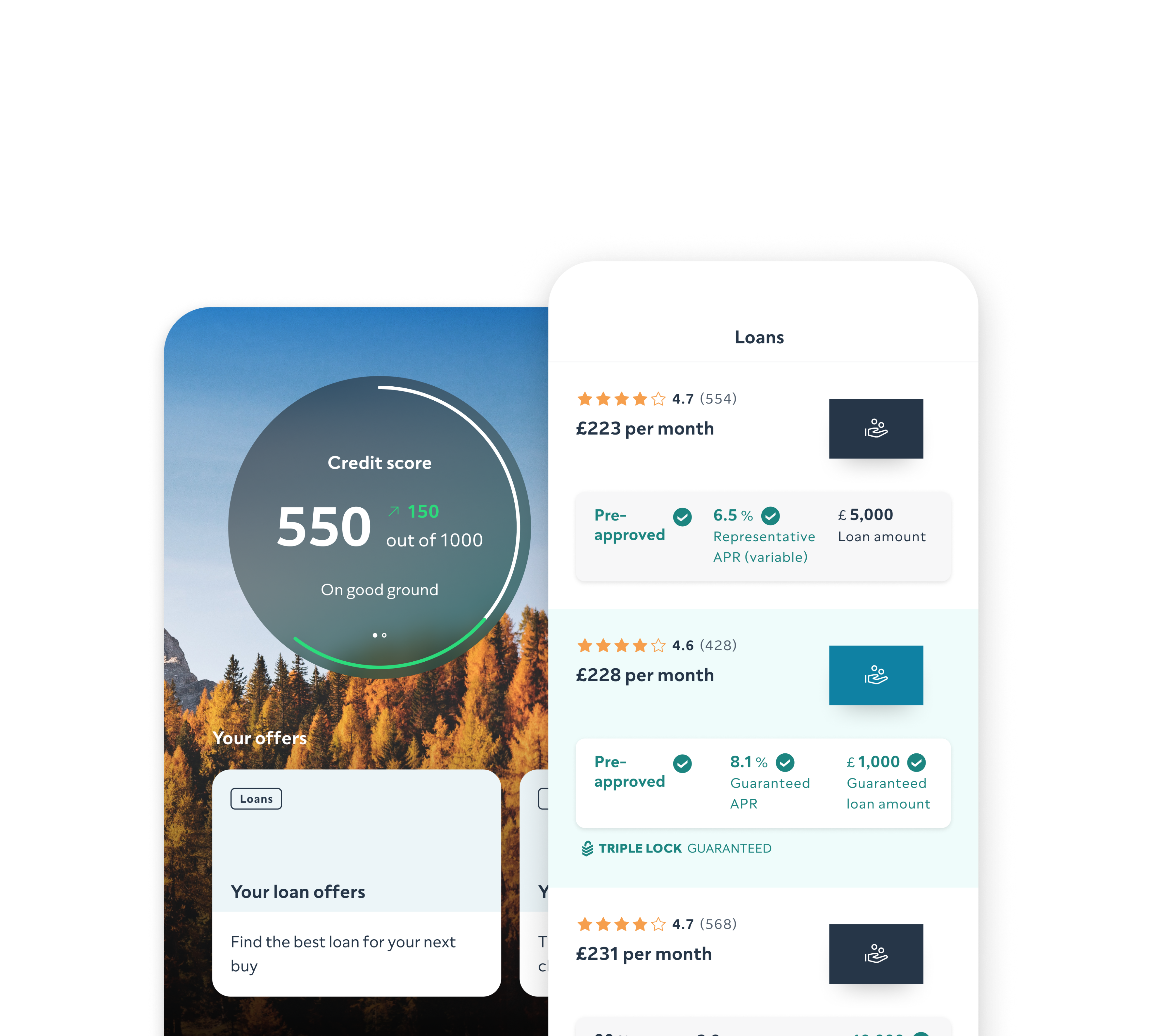

Sign up in a few easy steps

It only takes a few minutes and you’ll get your credit score and report for free, forever.

ClearScore is a credit broker, not a lender, 18+, T&Cs apply

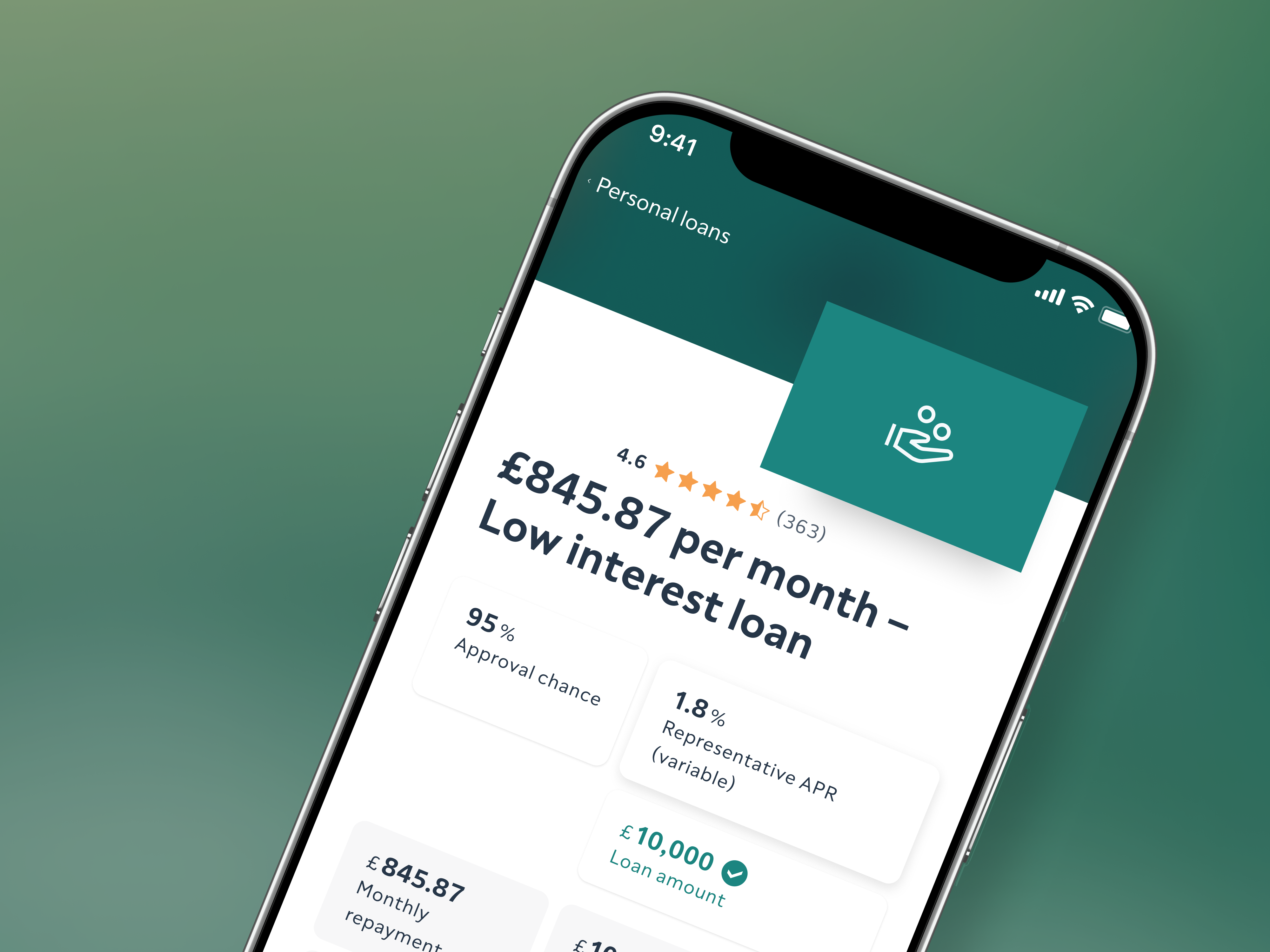

Use this calculator to see what your monthly loan repayments could look like.

£

%

The numbers you'll see are a guide only.

APR means annual percentage rate. It's made up of the interest rate and other charges you might have to pay (like an annual fee). We've added a representative example already, but you can change it. Bear in mind that these numbers are intended as a guide only.