How to choose the right credit card for you

To help narrow down your options, think about these things before applying for a credit card.

Know what you want it for

Deciding what you’d like to use the card for – transferring your balance, building your credit score, or rewards, for example – is the first step.

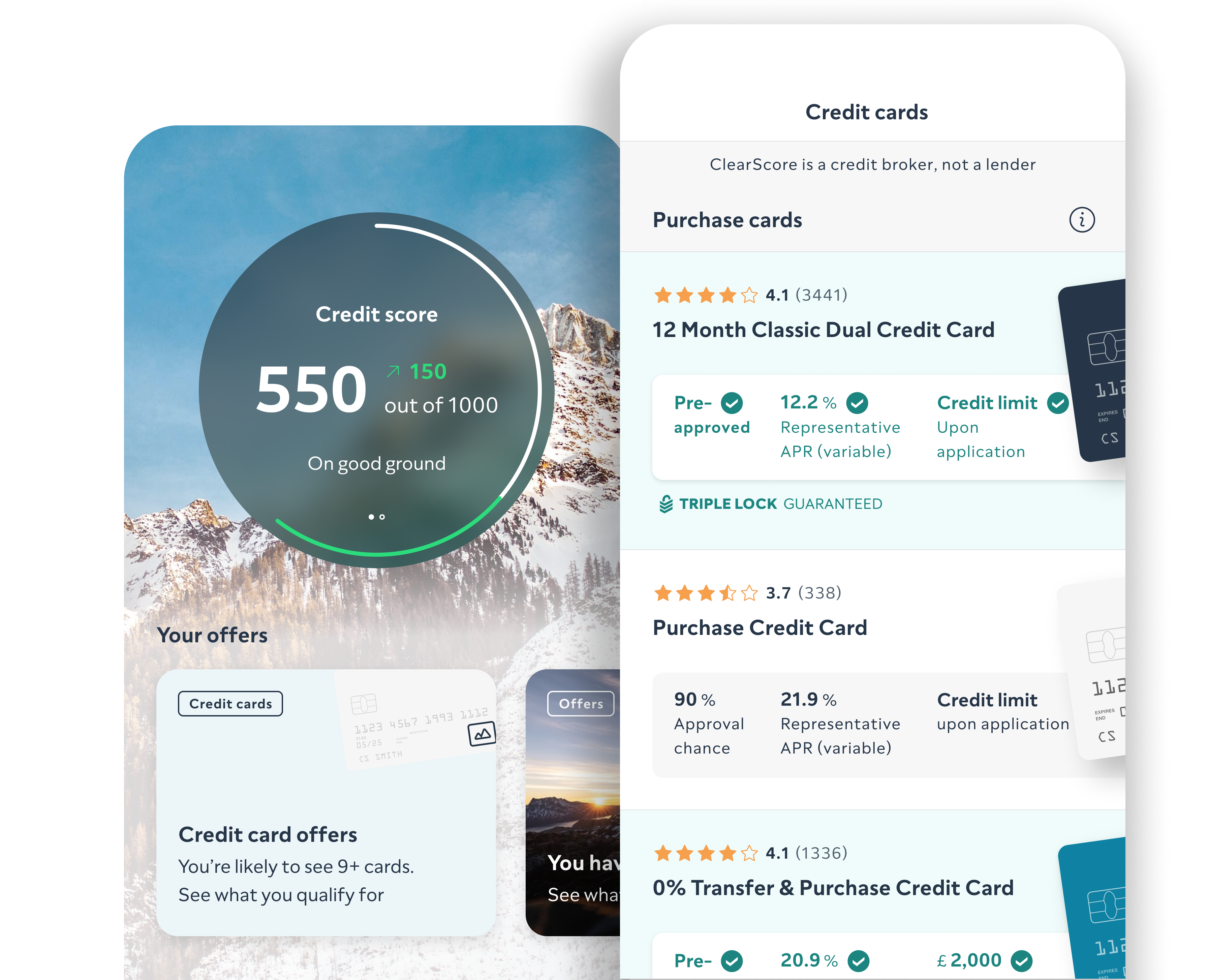

See how much you could borrow

Comparing offers will give you an idea of how much you can borrow. Then, you can see which credit limit works best for you.

Check the interest rate

Some cards come with 0% interest for a few months. So make sure you know what the interest rate will be after the promotional period ends. Other cards will come with high interest rates from the start – but if you’re confident you can make the repayments in full every month, you won’t need to worry about the rate as much.

Look for additional fees

Rewards cards, for example, often come with an annual or monthly fee. And some other cards will charge you for taking out money at a cash machine. The lender should make it clear what fees apply in their terms and conditions.

Find out what your eligibility is

When you apply for a credit card, lenders will carry out a hard search – this will show on your credit report and be visible to other lenders. So, it’s a good idea to know what your chances are before starting the application process. At ClearScore, we’ll show you your approval chance for each credit card.